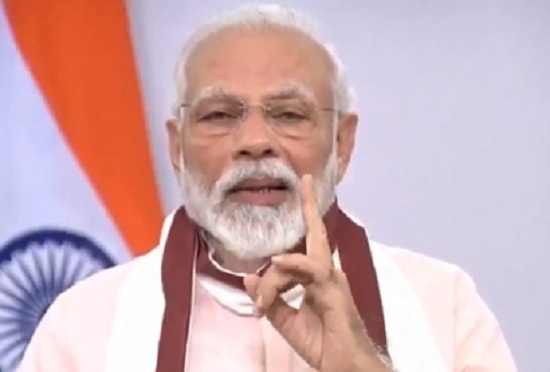

Today union finance minister Nirmala Sitharaman gave details of Atmanirbhar Bharat Abhiyan package worth Rs 20,000 crores announced by Prime Minister of India Narendra Modi yesterday evening during address to nation through TV channels at 8 pm.

FM Sitharaman Atmanirbhar Bharat Abhiyan package details through a press conference.

Government of India will facilitate provision of Rs. 20,000 cr as subordinate debt for two lakh MSMEs which are NPA or are stressed.

To provide relief to businesses, it is proposed to extend to them additional working capital finance of 20 percent of their outstanding credit as on 29 February 2020.

The Government of India will set up a Fund of Funds with a corpus of Rs 10,000 crore that will provide equity funding support for MSMEs

Definition of MSMEs will be revised by raising the Investment limit. An additional criteria of turnover is also being introduced. A legislation for the purpose will be brought in the Monsoon Session.

Within the next 45 days, Government of India and CPSEs will honour all dues to MSMEs.

This will enable a self-reliant India, will support Make in India, and will also help MSMEs to increase their business.

All central agencies like Railways, Ministry of Road Transport and Highways and CPWD will give extension of up to six months for completion of contractual obligations.

Will ensure that e-market linkages are provided to MSMEs.

Employees Provident Fund Support for business and organised workers will be extended by another 3 months for salary months of June, July and August 2020.

It has been decided to advise State governments to invoke the Force Majeure clause under RERA. The registration and completion date for all registered projects will be extended up to six months.

It has been decided to reduce statutory PF contribution of both employer and employee to 10% each from existing 12% each for next 3 months for all establishments covered by EPFO.

The main benefit of this will be to provide liquidity support for NBFCs, HFCs, MFIs, and mutual funds and will create confidence in the market.

The government will launch a Rs 30,000 crore Special Liquidity Scheme for NBFCs, HFCs and MFIs. This will supplement the RBI’s and government’s measures to augment liquidity.

This Scheme will result in liquidity of Rs 45,000 crore. The first 20% of loss will be borne by the government of India.

This move will provide relief for about 6.5 lakh establishments and about 5 crore employees.

The existing Partial Credit Guarantee scheme is being revamped and now will be extended to cover the borrowings of lower rated NBFCs, HFCs and other Micro Finance Institutions (MFIs).

The benefit of these measures will be to de-stress real estate developers and ensure completion of projects.

The TDS rates for all non-salaried payment to residents, and tax collected at source rate will be reduced by 25 percent of the specified rates for the remaining period of FY 20-21.

Power Finance Corporation and Rural Electrification Corporation will infuse liquidity in the DISCOMS to the extent of Rs 90,000 crores in two equal instalments.

The loans will be given against State guarantees for the exclusive purpose of discharging liabilities of Discoms to Gencos.

All central agencies like Railways, Ministry of Road Transport and Highways and CPWD will give extension of up to six months for completion of contractual obligations.

It has been decided to advise State governments to invoke the Force Majeure clause under RERA. The registration and completion date for all registered projects will be extended up to six months.

This measure shall be applicable for the remaining part of the financial year 2020-21.

Atmanirbhar Presentation Part-1 Business including MSMEs 13-5-2020