Ahmedabad, 27th June 2018: Post the merger with DHFL Vysya Housing Finance, strategic moves and geographical spread through the year, FY 2017-18, Aadhar Housing Finance Ltd has shown remarkable performance and rapid growth.

Aadhar Housing Finance, as a merged entity on comparable basis, has reported a rise of 103% per cent in net profit compared to the last financial year. In the financial year 2017-18, the company has reported a profit of Rs. 100 cr compared to Rs. 49 cr in FY 2016-17.

The total income increased to Rs. 798 cr from Rs. 543 cr in the year-ago period. The loan disbursement during the FY 2017-18 was Rs. 3900 crores as against Rs. 2300 crores in FY 2016-17. The Gross Retail NPA(on AUM) was at 0.58% as on March 31, 2018.

The total assets under management (AUM) grew to Rs. 7966 Cr crore by the end of FY 2017-18 from Rs. 4991 crores in FY 2016-17.

Aadhar focuses more on Economically Weaker Section and Low Income Segment with average ticket size of 8 lac. The company with its philosophy – Home loan, for everyone, caters to home loan needs of salaried, small business and Informal segment who do not have sufficient income proof.

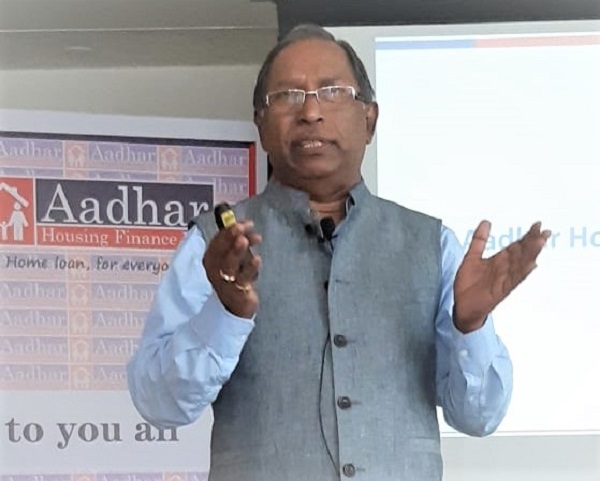

“The ‘Housing for all’ scheme has given a big boost to the affordable housing finance segment, as the result of which the performance of the merged entity has been excellent for the FY 2017-18. Aadhar expects to achieve 55% growth in disbursements by adding 75000 new accounts in the current year, while maintaining the NPA at 0.5%.” said Mr. Deo Shankar Tripathi, Managing Director and CEO, Aadhar Housing Finance Ltd.

Aadhar conducts various financial literacy programs across all the branches to educate people about fulfilling their housing needs and availing benefits of PMAY. Aadhar truly believes in transparency and customer centricity.

To service the customers efficiently and to decrease the turnaround time (TAT), Aadhar has set up a Central Processing Unit (CPU) in Mumbai. This will help Aadhar to expand its reach and enrich the customer experience. The company is continuously investing in technology to service the low income segment in the suburban locations, who are not tech savvy by implementing VOICE (IVR based messages) and VIDEO (customer awareness series etc.) based communications in the regional languages.

Aadhar is also offering an attractive fixed deposit (CRISIL rating FAA/Stable) scheme that provides attractive Interest rates ranging from 8.25% to 8.50% for different maturities with additional interest of 0.25% to Senior Citizens, Women & Armed Forces Personnel. The fixed deposit product also provides loan facility on FD to meet urgent requirements.

Aadhar is covering 1500 additional locations from its 275 branches through an effective hub n spoke model where a hub branch caters to surrounding spoke locations; these spoke locations are proposed to be increased to 2500 by providing dedicated resident manpower to effectively reach

out to customers in these new locations. The company has setup an ‘Alternate Channel’ to drive these new initiatives.

In the state of Gujarat, Aadhar has 21 branches. Aadhar plans to open 7 more branches this year in Gujarat taking the total branch count to 28 to cover 150 locations in the state.

About Aadhar Housing Finance Limited (www.aadharhousing.com)

Aadhar Housing Finance Limited (Aadhar), erstwhile DHFL Vysya Housing Finance Ltd, a subsidiary of Wadhawan Global Capital (WGC), is one of the largest affordable housing finance companies in India servicing the home financing needs of the low-income segment of the society.

Aadhar is backed by the World Bank through the equity participation of International Finance Corporation (IFC). The company has a vast network of 275 branches spread in 19 states having 90% of low income housing requirement..