Incubating Businesses EBITDA up by 68% to Rs. 10,025 cr

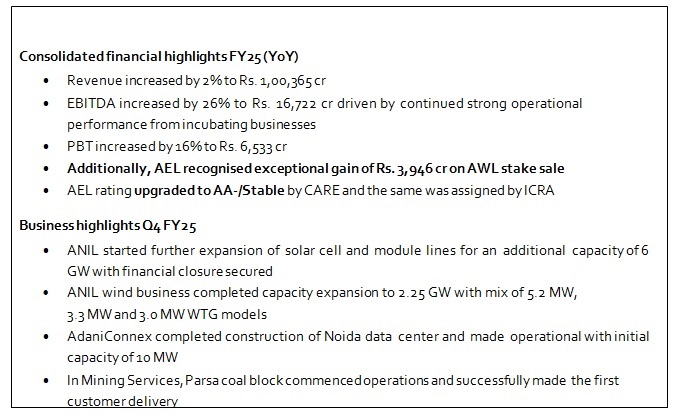

Ahmedabad, May 01, 2025: Adani Enterprises Ltd (AEL), the flagship company of the Adani Group, and the incubator of Adani Group, announced its results today for the quarter and year ended March 31, 2025.

The incubation strength of AEL is strongly validated by these results. The consistency in the performance and growth of its incubating businesses is being reflected in each quarterly results over the last few years. AEL has not only delivered robust operational and financial performance but also has remained focused on the timely completion of large infra projects, capacity extension and asset utilization of its businesses.

“At Adani Enterprises, we are building businesses that will define the way forward for India’s infrastructure and energy sector,” said Mr Gautam Adani, Chairman of the Adani Group. “Our robust performance in FY25 is a direct outcome of our strengths in scale, speed and sustainability. Impressive growth across our incubating businesses reflects the power of disciplined execution, future-focused investments and a commitment to operational

excellence, innovation and sustainability. As we scale up in energy transition, airports, data centers and mining services, we are creating new market leaders that will drive India’s growth story for decades to come. Each success across our incubation spectrum accelerates our mission to create long-term value and catalyses India’s emergence as a global economic powerhouse.”

Consolidated Financial Highlights

(Rs. in Crore)

| Particulars | Q4 FY24 | Q4 FY25 | % change Y-o-Y | FY24 | FY25 | % change Y-o-Y | |

| Total Income | 29,630 | 27,602 | (7%) | 98,282 | 1,00,365 | 2% | |

| EBITDA | 3,646 | 4,346 | 19% | 13,237 | 16,722 | 26% | |

| Exceptional Gain/(Loss) | (627) | 3,946 | – | (715) | 3,946 | – | |

| Profit Before Tax | 694 | 5,259 | 6.6x | 4,925 | 10,479 | 1.1x | |

| Profit After Tax1 | 449 | 3,8452 | 7.5x | 3,240 | 7,1122 | 1.2x | |

| Cash Accruals3 | 1,662 | 1,190 | (28%) | 7,076 | 7,968 | 13% |

Note: 1. PAT attributable to shareholders

- Includes post-tax exceptional gain of Rs. 3,286 cr from AWL stake sale of 13.5% sale

- Cash Accruals = Profit Before Tax + Depreciation – Current Taxes

Incubating Businesses Financial Highlights

(Rs. in Crore)

| Particulars | Q4 FY24 | Q4 FY25 | % change Y-o-Y | FY24 | FY25 | % change Y-o-Y | |

| ANIL Ecosystem | |||||||

| Total Income | 2,775 | 3,661 | 32% | 8,741 | 14,236 | 63% | |

| EBITDA | 641 | 1,110 | 73% | 2,296 | 4,776 | 1.1x | |

| PBT | 536 | 925 | 73% | 1,884 | 3,958 | 1.1x | |

| Airports | |||||||

| Total Income | 2,195 | 2,831 | 29% | 8,062 | 10,224 | 27% | |

| EBITDA | 662 | 953 | 44% | 2,437 | 3,480 | 43% | |

| PBT | 29 | (5) | – | (68) | (5) | – |

Operational Highlights

| Volume | Q4 FY24 | Q4 FY25 | % change Y-o-Y | FY24 | FY25 | % change Y-o-Y | |

| ANIL Ecosystem | |||||||

| Module Sales (MW) | 797 | 990 | 24% | 2679 | 4263 | 59% | |

| WTG (Sets) | 47 | 60 | 28% | 54 | 164 | 2x | |

| Airports | |||||||

| Pax movement (Mn) | 23.2 | 24.7 | 6% | 88.6 | 94.4 | 7% | |

| ATMs (‘000) | 153.0 | 157.8 | 3% | 593.8 | 623.8 | 5% | |

| Cargo (Lacs MT) | 2.7 | 2.7 | – | 10.1 | 10.9 | 8% | |

| Roads | |||||||

| Construction (L-KM) | 284.6 | 694.6 | 1.4x | 514.8 | 2410.1 | 3.7x | |

| Mining Services | |||||||

| Dispatch (MMT) | 10.7 | 14.0 | 30% | 30.9 | 43.3 | 40% | |

| IRM | |||||||

| Volume (MMT) | 24.7 | 15.3 | (38%) | 82.1 | 56.5 | (31%) |

Business Updates

| Adani New Industries (ANIL – Green Hydrogen Ecosystem) |

| Solar manufacturing Module sales increased by 59% y-o-y basis to 4263 MW with higher EBITDA margins on account of improved realization and operational efficiencyConstruction started for additional 6 GW cell and module line capacity extension with financial closure secured |

| Wind Turbine manufacturing Capacity increased to 2.25 GW (450 sets p.a.) with its offerings of four listed WTG modelsWon “ICC Green Energy award” in the 5th edition of Green Urja and Energy Efficiency awards |

| AdaniConnex Pvt Ltd (ACX – Data Center) |

| Hyderabad Data Center Phase II of Hyderabad Data Center of 9.6 MW C&S 100% and MEP ~38% completed |

| Noida Data Center Construction completed for 50 MW C&S and 10 MW MEP |

| Pune Data Center Construction completion for Pune I ~78% and Pune II ~89% for Phase I – 9.6 MW each |

C&S: Core & Shell | MEP: Mechanical, Electrical & Plumbing

| Adani Airport Holdings Ltd (AAHL – Airports) |

| 12 new routes and 8 new flights added during the quarterMumbai Airport received Outstanding Achievement “Diamond Rating” in emission reduction from Global Energy and Environment Foundation |

| Natural Resources – Mining Services |

| Parsa coal block is operational with peak capacity of 5 MMTPAPortfolio of 13 mining service contracts, of which six are operational |

| ESG Highlights |

| The CDP-CC has upgraded AEL rating to A- for 2024 which denotes “Leadership Category” indicating AEL’s dedication and commitment to lowering GHG emissionsAEL is also rated “Strong” with a score of 67.5 by ESG Risk Assessment & Insight for its overall improvement in ESG performance |